Only a small minority of families will have to pay estate taxes to the federal government after a loved one dies. There are actually twelve states along with the District of Columbia that levy an estate tax and most have exemption amounts that are lower than the federal amount.

2022 Real Estate Tax Exemption Which Device To Choose To Reduce Your Tax

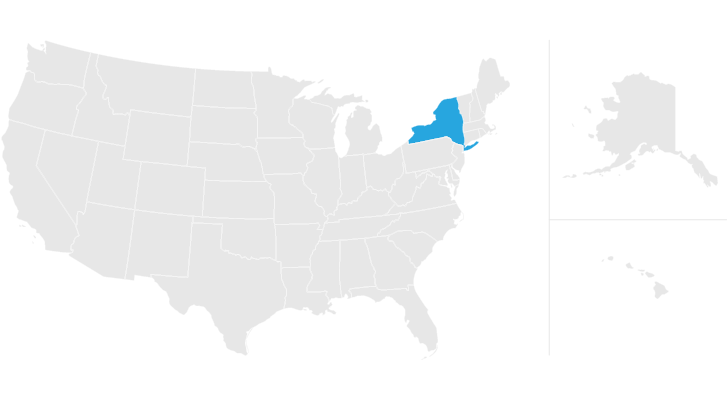

The New York States estate tax exemption for 2022 is 6110000 million.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

. If in the future a revised exemption is determined which is five percent or more different than the exemption indicated a new exemption will be. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation-adjusted. As of the date of this article the exact exclusion amount for 2022 has not been released.

You may need to report this information on your 2021 federal income tax return. It is anticipated to be a little over 6 million in 2022. New York estate tax update for 2022.

For more information see the General Information section and the instructions for lines 13 and 26 on Form ET-706-I and also TSB-M-19-1E. ST-1213 Fill-in Instructions on form. Town of Westerlo.

This means that if a persons estate is worth less than 611 million and they die in 2022 the estate owes nothing to the state of New York. In 2022 the New York estate tax exemption is 6110000 up from 593mm in 2021. You can find all the details on tax rates in the Revenue Procedure 2021-45.

Provided a persons taxable estate falls into the Estate tax cliff range which occurs between 611 million and 6711 million in 2022 a person falls off the estate tax cliff in New York state. New York Estate Tax. The IRS recently announced inflation adjustments for the 2022 tax year with Estate Tax rates and Trust tax.

ST-1211 Fill-in Instructions on form. In 2022 the law assesses no taxes on an individual taxable estate of less than 12000000. 16 rows What is the current exemption from New York estate tax again.

The above exemption amounts were determined using the latest data available. New York is one of the states that administers their own NY estate tax and has a relatively low NY estate tax exemption amount. The current New York.

New York Estate Tax Exemption. Exemption Certificate for Tractors Trailers Semitrailers or Omnibuses. If someone dies in September 2022 leaving a taxable estate of 7 million the estate would exceed the New York exempt amount 6110000 by 890000.

ST-1212 Fill-in Instructions on form. In New York for the year 2022 a single persons estate is subject to tax beyond what New. New York State does not recognize portability so unlike federal law which enables a surviving spouse to make use of the deceased spouses unused estate tax exemption New York law requires some extra planning.

New York has an estate tax exemption of 5930000. New Yorks estate tax law has a significantly lower threshold. New York State still does not recognize portability.

New york state residents the estate of an individual who was a nys resident at the time of death must file a nys estate tax return if the total of the federal gross estate plus any includible taxable gifts made while the individual was a resident of new york state exceeds the. That number will keep going up annually with inflation. Despite the large Federal Estate Tax exclusion amount New York States estate tax exemption for 2021 is 593 million.

Despite the large Federal Estate Tax exclusion amount New York States estate tax exemption for 2021 is 593 million. For 2022 the federal estate tax exemption is 12060000 and the top federal estate tax rate is 40. Even if a deceaseds estate is not large enough to owe federal estate tax individuals may still owe an estate tax to the state of New York.

New York State and Local Sales and Use Tax Exempt Use Certificate. As of the date of this article the exact exclusion amount for 2022 has not been released. Although the top New York estate tax rate.

This is the amount that a person can pass on to heirs at his or her time of death without being obligated to pay New York state estate taxes. As more current data becomes available these exemptions are subject to change. The New York estate taxthreshold is 592 million in 2021 and 611 million in 2022.

When you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount Federally or the basic exclusion amount in New York State. Up to 25 cash back The New York Estate Tax Cliff By contrast New York taxes the entire value of an estate that exceeds the exemption by more than 105. Trusts and Estate Tax Rates of 2022.

For people who pass away in 2022 the Federal exemption amount will be 1206000000. The New York estate tax exemption amount is currently 5930000 for 2021. Here is what you need to know.

The New York estate tax exemption equivalent increased from 593 million to 611 million effective January 1 2022 but continues to be phased out for New York taxable estates valued between 100 and 105 of the exemption amount with no exemption being available for taxable estates in excess of 105 of the exemption amount. In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. New Yorks estate tax exemption is 5930000 for 2022 up from 5850000 for.

In 2022 the New York estate tax exemption is 6110000 up from 593mm in 2021. The high federal estate tax exemption is still in place - 12060000 in 2022 up from 11700000 million in 2021. But dont forget estate tax that is assessed at the state level.

This means that a New Yorker passing away with more than the exemption amount or a non NY resident with tangible or real property in NY in excess of the exemption must pay a. The connecticut state gift estate tax exemption has increased from 71 million in 2021 to 91 million in 2022. In other states the estate would pay a tax based on.

The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019. It is anticipated to be a little over 6 million in 2022. For previous periods see information for dates of death on or after February 1 2000 and before April 1 2014.

New York State still does not recognize portability. Exemption Certificate for Purchases of Promotional Materials.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

It May Be Time To Start Worrying About The Estate Tax The New York Times

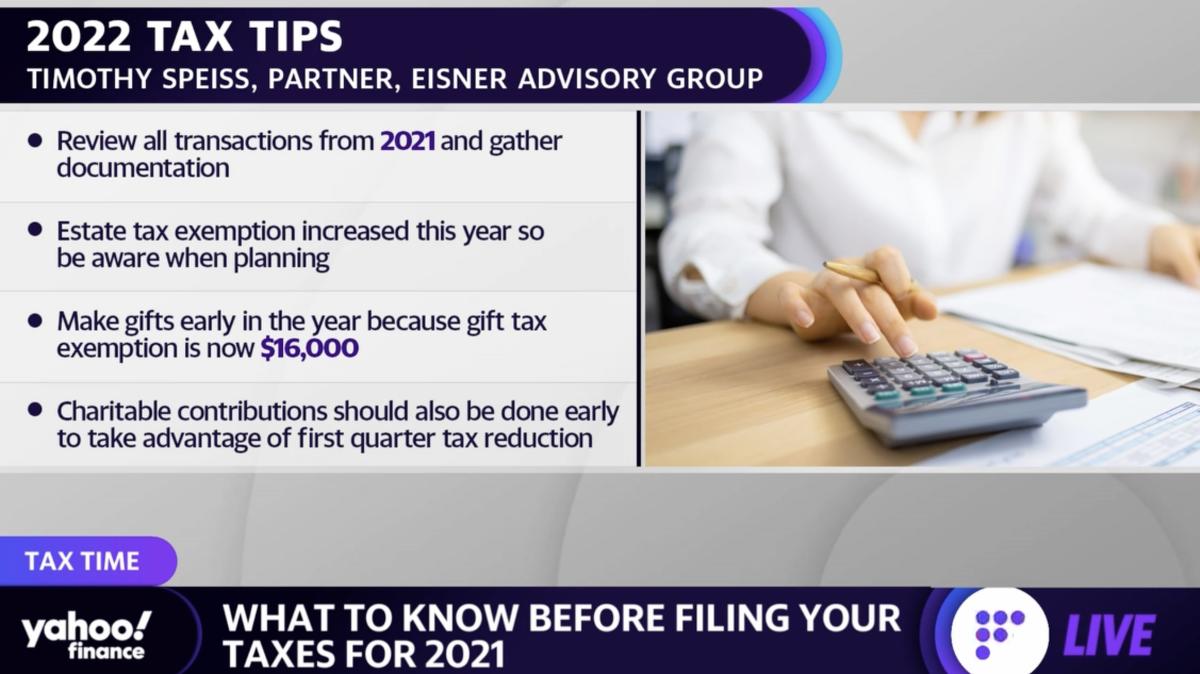

Taxes 7 Tips To Prepare For The 2022 Tax Season

Build Back Better Act Trusts And Estates

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

How The Tcja Tax Law Affects Your Personal Finances

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Tax Exemption Saves Owners Of New Homes In Nassau County

Lifetime Qtipable Trusts For Gift Estate Tax Exemption Planning New York Law Journal

Increased Us Gift And Estate Tax Exemptions And Further Planning Opportunities In 2022

2022 Updates To Estate And Gift Taxes Burner Law Group

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

New York Estate Tax Everything You Need To Know Smartasset

New York S Death Tax The Case For Killing It Empire Center For Public Policy

How To Avoid Estate Taxes With A Trust

New York S Death Tax The Case For Killing It Empire Center For Public Policy

What Is A Homestead Exemption And How Does It Work Lendingtree