You the user of this Website are responsible for insuring payments have been made. Median Property Taxes Mortgage 1267.

Ultimate Guide To Understanding South Carolina Property Taxes

What this means is that if the marketappraisal value of your property is 180000 the assessed value is 7200 if you live in the home as your primary residence and 10800 if you use the property as a rental or vacation home or.

. We accept electronic check as well as credit and debit card payments through the Internet for ALL types of taxes including vehicle taxes. You can pay your property tax bill at the Tax Collectors department. Greenville County Auditor 301 University Ridge Suite 800 Greenville SC 29601.

301 University Ridge Suite 1000. 3 on January 16 an additional 7 on February 2 and an additional 5 plus. You can access our telephonic payment service by calling 18442576200.

Greenville county tax collector pay online Preview Show details Vehicle Other Taxes Search Greenville County SC. 005 - HORSE CREEK DUNKLIN FIRE 007 - SPEC ABATE CORRECTION COLL 008 - SPEC ABATE CORRECTION REF 015 - POSSUM KINGDOM S GVL FIRE 025 - COLUMBIA ANDERSON SCH-DUNKLIN 026 - POSSUM. Search for Voided Property Cards.

The median property tax on a 14810000 house is 155505 in the United States. Then you will owe taxes within one hundred twenty 120 days. Find Greenville County Property Tax Collections Total and Property Tax Payments Annual.

Median Property Taxes No Mortgage 982. You can also pay online. The countys average effective rate is 069.

The exception occurs when you allow a dealer to obtain your license tag. For more details about taxes in Greenville County or to compare property tax rates across South Carolina see the Greenville County property tax page. Capital Credit Union W7007 E Parkview Drive Greenville.

If paying by mail please make your check payable to Greenville County Tax Collector and mail to. Greenville County Tax Collector SC 301 University Ridge Suite 700 Greenville SC 29601 864-467-7050. The median property tax on a 14810000 house is 74050 in South Carolina.

Located in northwest South Carolina along the border with North Carolina Greenville County is the most populous county in the state and has property tax rates higher than the state average. This calculator can only provide you with a rough estimate of your tax liabilities based on the. Other fees about which we have no information about may apply.

Please Enter Only Numbers. The largest tax in Greenville County is the school district tax. Some of the revenues collected include real estate taxes.

We also accept tax payments over the telephone. Greenville County collects relatively low property taxes and is ranked in the bottom half of all counties in the United States by. Real property taxes and personal property taxes other than auto taxes are due without penalty by January 15.

Greenville County Real Property Services. Once you locate your property using the search methods above simply click the Add button to the left of the property to add it to. The median property tax on a 14810000 house is 97746 in Greenville County.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Greenville County SC at tax lien auctions or online distressed asset sales. The Real Property Services Office values over 222034 properties in Greenville County. Greenville South Carolina 29601.

Terms Greenville County Tax Collector SC Online Payments 601 864-467 Greenville Greenville County Tax Collector SC 301 University Ridge Suite 700 Greenville SC 29601 864-467-7050 Category. Greenville County SC currently has 1649 tax liens available as of May 31. 864 467 7300 Phone.

Your taxes are not paid until funds settle into our bank account. Tax Collector Suite 700. Several local banks will accept your tax payment at their drive-up area only during their regular business hours.

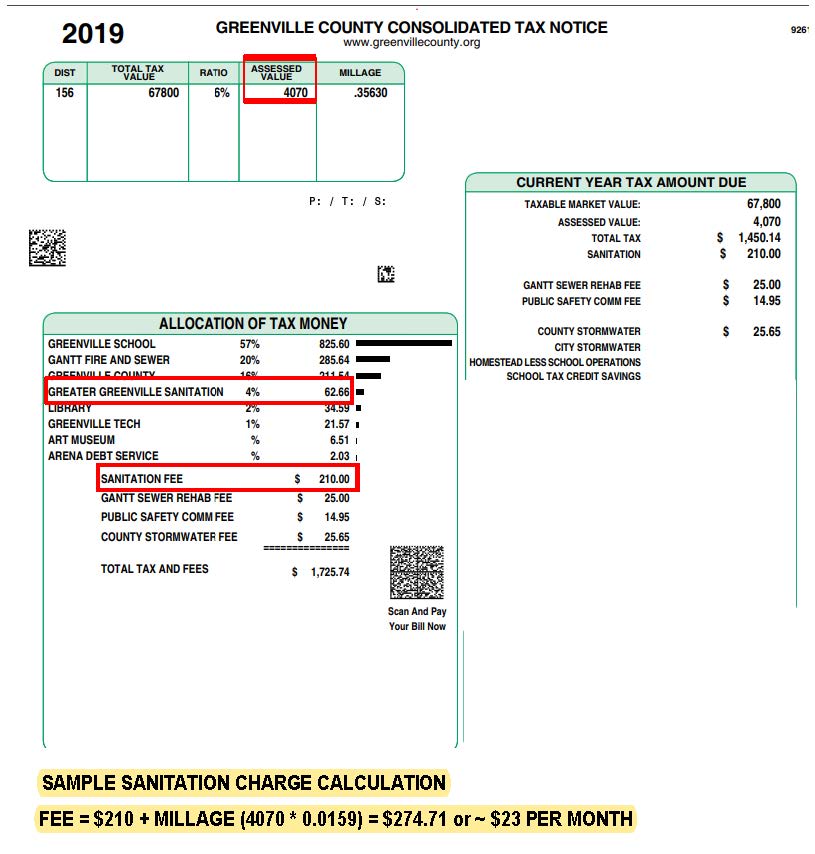

SC assesses taxes at a 4 rate for owner-occupied homes and at a 6 rate for other properties. The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value. Under a combined tax bill almost all sub-county entities arrange for Greenville County to levy and collect the tax on their behalf.

Greenville County Tax Collector SC 301 University Ridge Suite 700 Greenville SC 29601 864-467-7050. Final taxes are obtained by adding special assessment which is a flat rate levied for services like sanitation and storm water. You are about to pay your Greenville County SC Property Taxes.

Late payment penalties are added as follows. Until 5 pm Monday through Friday except on legal County sanctioned holidays. 1781 Greensville County Circle Emporia Virginia 23847 Office 434 348-4205 Fax 434 348-4113.

The department analyzes researches and processes deeds and plats annually to keep its database up to date. Please Enter Only Numbers. We have chosen to use AutoAgent as our merchant to provide these online and telephone.

Greenville County now allows the taxpayers to elect opt-in to receive their tax bills via electronic form. Get a Paid Property Tax Receipt for SCDNR Registration. If your vehicle is improperly qualified or you are uncertain whether your vehicle would be eligible for car tax relief because it is used part of the time for business purposes contact the Greensville County Commissioner of the Revenues Office at 434-348-4227.

Pay Your Greenville County Tax Collector SC Tax Bill Online. Greenville County South Carolina. Personal property returns cannot be filed electronically.

Paying Personal Property Taxes - You must pay one 1 year in advance in order to obtain a license tag. Property taxes continue to represent the main source of revenue for school districts special tax districts and local government under the. Customarily this budgetary and tax rate-setting exercise is complemented by public hearings convened to consider budget spending and tax affairs.

These buyers bid for an interest rate on the taxes owed and the right to.

Greenville County Council Candidates Answer Our Questions Bike Walk Greenville

South Carolina Property Tax Calculator Smartasset

Fees Annexation Greater Greenville Sanitation

Tax Rates Hunt Tax Official Site

How Greenville County Assesses Taxes The Home Team

Why Retire In Greenville South Carolina

Moving To Greenville Sc 10 Things You Ll Love About Your Move To Greenville Sc

What Does Annexing Actually Mean For Greenville And You Gvltoday

Why Land Values Are Rising In Greenville County South Carolina

Greenville Sc Real Estate Market Stats Trends For 2022

Want To Rent Your House Well You Re Going To Have To Pay Up Greenville Journal

2022 Best Places To Buy A House In Greenville County Sc Niche